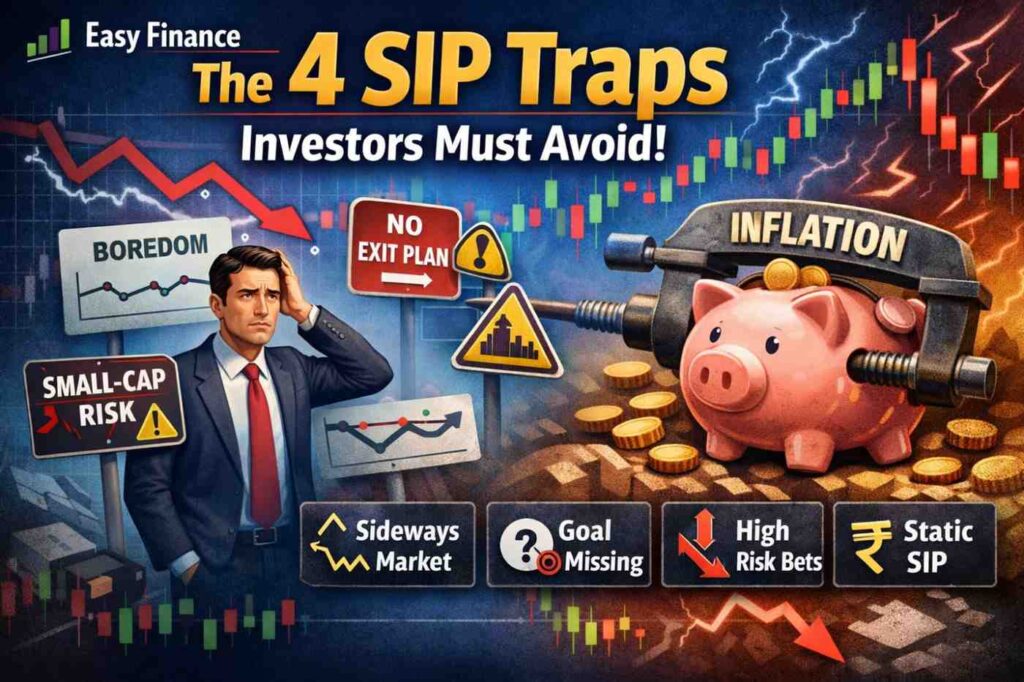

Think SIP is a “set it and forget it” magic trick? Think again. Discover the 4 dangerous SIP traps—from sideway markets to exit strategies—that could ruin your long-term wealth. Learn how to protect your portfolio today.

In the world of modern investing, ‘SIP’ (Systematic Investment Plan) has become a household name. From social media influencers to office colleagues, the advice is almost always the same: “Just start an SIP and forget about it.” But is “forgetting about it” actually a recipe for wealth, or a recipe for disaster?

A recent deep-dive video by Easy Finance has sparked a massive conversation by uncovering the “SIP Traps” that cause investors to lose out, even when the market is performing. If you are an SIP investor or planning to start one on Easy Gyaan, these four uncomfortable truths are essential reading.

1. The Boredom Trap: Surviving the Sideways Market

Most people start investing during a “Bull Run”—when everyone is making money and the charts are going up. They expect a consistent 15-20% return every year. However, reality often looks very different.

The Reality Check: Markets don’t always go up or down; sometimes, they stay flat for 2-3 years. This is known as a Sideways Market. During this phase, your portfolio returns might look worse than a basic bank Savings Account or FD. According to the video, during the market dip of 2025, nearly 35% of SIP investors stopped their plans. They had the discipline for three years, but as soon as the “boredom” hit, they gave up.

The Takeaway: The real test of an SIP isn’t a market crash; it’s boredom. If you can’t handle your portfolio looking stagnant for a few years, building long-term wealth will be nearly impossible. Don’t blame the fund; manage your expectations.

2. The Exit Trap: Investing Without a Goal

Most Indians are great at starting an investment but terrible at planning the exit. Imagine you’ve been doing an SIP for 15 years for your child’s higher education. For 14 years, your portfolio looks amazing. But in the 15th year—exactly when you need the cash—the market crashes by 20%. What do you do? You can’t “pause” your child’s education.

The Solution: You need a Redemption Strategy. As you get within 2-3 years of your financial goal, you must start moving your money from volatile Equity Funds to safer Debt Funds.

- Use SWP (Systematic Withdrawal Plan): This allows you to exit the market gradually, protecting your gains from sudden market crashes right before you need the money.

Without an exit plan, 15 years of disciplined saving can be wiped out by one bad month in the market.

3. The Small-Cap Mania: Chasing High Returns

Driven by the massive returns seen in 2024, millions of new investors have flooded their portfolios with Small-Cap and Mid-Cap funds. In some cases, these high-risk funds make up 80% of their total investment.

The Danger: Small-cap funds are like sports cars—they go fast, but they crash hard. Are you prepared to see your portfolio drop by 40-50% in a single year? If you are over 40 years old or don’t have a solid emergency fund, putting all your money into Small-Caps isn’t investing; it’s gambling.

Key Rule: Diversify. Don’t let greed dictate your asset allocation.

4. The Inflation Trap: The Static SIP

Are you still investing the same ₹5,000 you started with years ago? If your income has increased but your SIP amount hasn’t, you are technically becoming poorer every year.

The “Step-Up” Necessity: Inflation erodes the value of money. ₹5,000 in 2018 had much more purchasing power than ₹5,000 in 2026.

- Step-Up SIP: You should aim to increase your SIP amount by at least 10% every year in line with your salary hikes. If your investment doesn’t grow with your lifestyle, the final “lump sum” you receive after 10 years will feel disappointingly small.

Summary: How to Win at the SIP Game

SIP is not a magic formula; it is a tool. To make sure it works for you:

- Don’t Stop: When the market goes sideways, keep going. That’s when you buy units at a “discount.”

- Plan the End: Know exactly how and when you will withdraw your money.

- Balance your Risk: Don’t put all your eggs in the Small-Cap basket.

- Step it Up: Increase your investment as your income grows.

At easygyaan.com, we believe that financial freedom isn’t just about investing—it’s about investing correctly. Don’t let these traps ruin your financial future.

Useful Links – Gold ETF vs. Physical Gold: Stop Paying Making Charges!

Leave a Reply